Andy Headley – Veritas Asset Management

Andy Headley – Veritas Asset Management

Partner, Fund Manager and Head of Global of Veritas Asset Management LLP. Co-Fund Manager of the Veritas Global Focus Fund, Veritas Global Equity Income Fund and Veritas Global Real Return Fund. Joined the company in 2003. Andy has been instrumental in developing the real return investment philosophy and process of the Veritas Global Product. He is head of research in which role he directs and mentors the Global analytical team. He undertakes a key role deciding upon the themes for the global strategies and is responsible for their implementation. Analyst and Portfolio Manager WP Stewart 2001 to 2003. Analyst and Portfolio Manager Newton Investment Management 1996 to 2001. Tax Consultant, Price Waterhouse 1993 to 1996. Education: Chartered Accountant, BSc, ACA, ASIP.

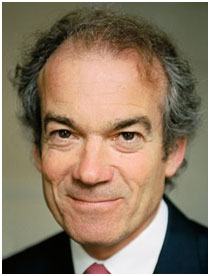

Richard Oldfield – Oldfield Partners

Richard Oldfield – Oldfield Partners

Richard Oldfield is Executive Chairman of Oldfield Partners, which he founded in 2005, after 9 years as Chief Executive of a family investment office. Prior to this, he was director of Mercury Asset Management plc, which he joined in 1977. He became Chairman of the Oxford University investment committee and Oxford University Endowment Management Ltd in January 2007, was Chairman of Keystone Investment Trust plc from 2001 to 2010 and is a director of Witan Investment Trust plc. He is the author of “Simple But Not Easy”, a “slightly autobiographical and heavily biased” book about investing

Hassan Elmasry, Independent Franchise Partners

Hassan Elmasry, Independent Franchise Partners

Hassan is a partner and lead portfolio manager at Independent Franchise Partners, LLP. He has 30 years of investment experience. Prior to founding the Firm in June 2009, Hassan was Managing Director and lead portfolio manager for Global and American Franchise portfolios at Morgan Stanley Investment Management. Hassan joined Morgan Stanley in 1995. Previously, Hassan was an international equity portfolio manager for Mitchell Hutchins Asset Management and worked as an international equity analyst for First Chicago Corporation. Hassan received an A.B. in Economics and an M.B.A. in Finance, both from the University of Chicago. He is a CFA® Charterholder.

David is the Portfolio Manager for the Global Equity Focus Fund at Towers Watson and Director of the Equity Research team. Alongside his portfolio management responsibilities David provides regular research input to a number of clients, including a large UK based investment trust. David joined from Stamford Associates where he was Deputy CIO responsible for devising and implementing investment strategies for a range of its largest investment clients. Prior to Stamford Associates, David established Greentrees Partners LLP as a joint venture with Collins Stewart before which he gained broad investment experience as a UK equity portfolio manager with UBS Global Asset Management (formerly Phillips and Drew) from 1998 and then as a UK equity portfolio manager with Morley Fund Management from 2003. In total David has 20 years of portfolio management and investment analyst experience. David is a member of the Chartered Institute for Securities and Investment (CISI).

Dan is the FT’s capital markets editor, overseeing a team focused on bonds, equities, derivatives, regulation, ETFs, investment and trading. He previously wrote for FT Alphaville, after stints on Lex and as the FT’s investment correspondent in New York, where he wrote about hedge funds and asset management. Before that Dan worked briefly at the Investors Chronicle, and has at one point or another carried furniture, sold kids books on doorsteps, and painted but not really decorated. He also spent four years loitering in Citigroup’s equity research department where he picked up a few ideas about the value of luck, timing and a catchy pitch.

Gary Channon, Phoenix Asset Management

Gary Channon, Phoenix Asset Management

Gary Channon co-founded Phoenix Asset Management Partners in 1998 and has managed the Phoenix UK Fund since its launch in May the same year. Since inception, the Fund has returned gross performance of 749% (versus the benchmark’s total return of 120%), an annualised return of 13% (versus the benchmark annualising at 4.6%). The investment philosophy at Phoenix is strongly inspired by Warren Buffett and Phil Fisher: long-term, value-based and focused. In terms of investment research, Phoenix considers its own primary fieldwork to be a major contributor to the effectiveness of the research effort. Typically, this includes assessing product quality via mystery shopping and undertaking competitor analysis in order to understand the purchasing decision of the marginal customer. Prior to Phoenix, Gary was co-Head of Equity and Equity Derivatives Trading at Nomura International, and before that he was at Goldman Sachs within Global Equity Derivative Products Training.

Simon Denison-Smith, Metropolis Capital

Simon Denison-Smith, Metropolis Capital

Simon is one of the two founders of the SF Metropolis Valuefund, a focused portfolio of global equities, applying value disciplines which draw extensively from the founders’ experience of private company buy-outs. Simon has been a Director of the Metropolis Group, since its inception in 1994. Prior to this, he was a strategy consultant with Bain & Co. He also founded Rave Technologies, a software business that services clients across a wide range of industries. Simon sold this business to Northgate IS PLC in 2006, delivering a 32% annualised return to investors over a 13 year period. Simon graduated from Bristol University with a BSc in Economics